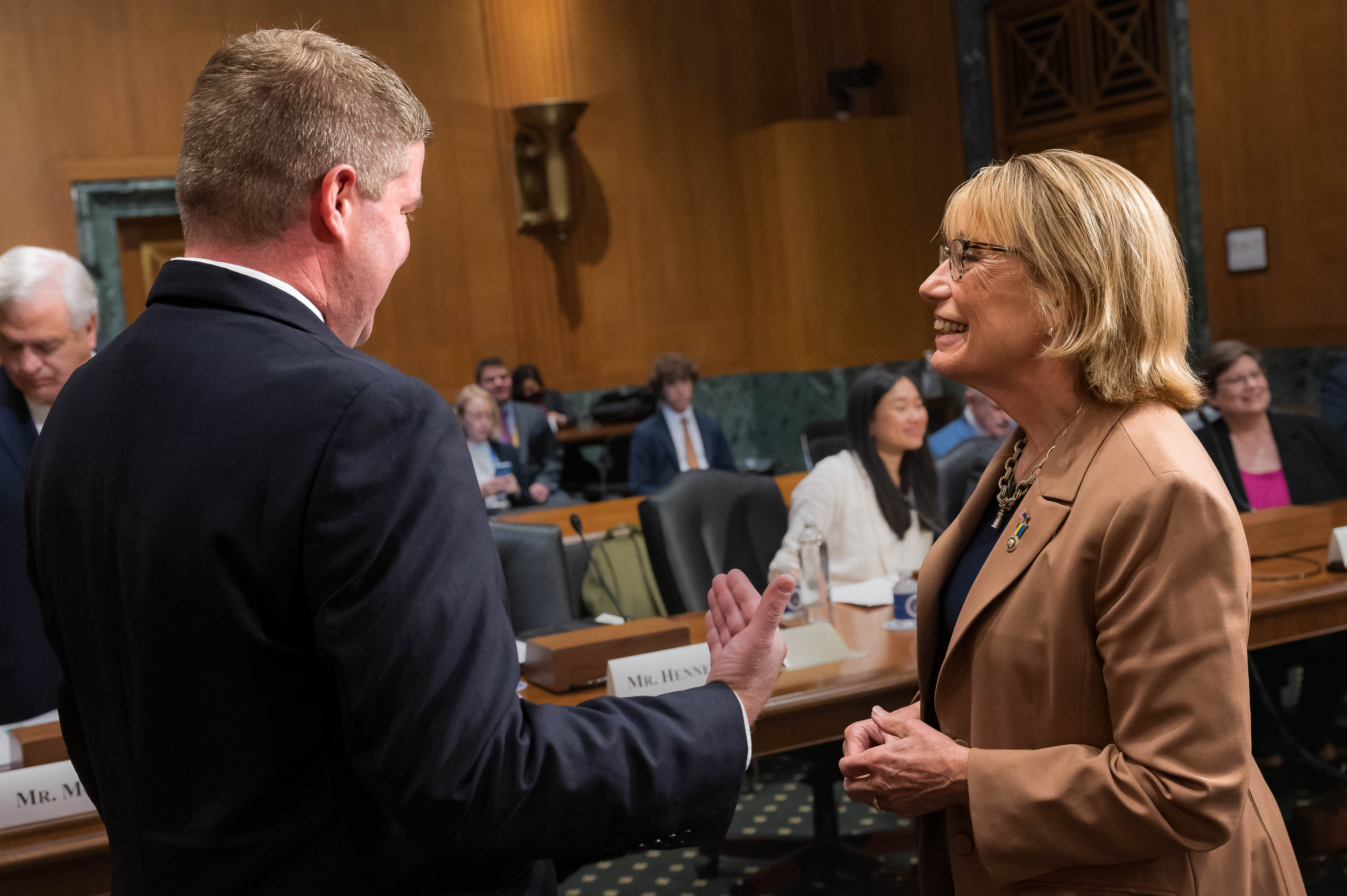

Senator Hassan Pushes Back on Out-of-State Taxes from Wayfair Decision at Senate Finance Hearing

Senate Finance Committee Holds Hearing Following Senator Hassan’s Bipartisan Request, Features New Hampshire Witness John Hennessey

WASHINGTON— U.S. Senator Maggie Hassan, a member of the Senate Finance Committee, pushed back against out-of-state taxes on small businesses resulting from the burdensome Supreme Court Wayfair ruling. In February, Senator Hassan led a bipartisan call for the Committee to hold this hearing, which featured John Hennessey, President & CEO of Littleton Coin Company, which is based in Littleton, NH.

Watch Senator Hassan’s questioning and Mr. Hennessey’s testimony here.

“John has been with the company for 15 years and – as we’ll see from his testimony – has seen first-hand the significant burdens that out-of-state governments have imposed on small businesses following the Wayfair decision,” said Senator Hassan in her introduction of Mr. Hennessey.

“Prior to the Wayfair ruling, we had never been subject to collecting state and local sales taxes,” said Mr. Hennessey. “The ruling immediately required us to become the tax collector for up to 12,000 different state and local jurisdictions – with no way to calculate and collect the taxes from our customers, leaving us liable to pay the bill ourselves.”

Senator Hassan and Mr. Hennessey discussed the burden that Wayfair has placed on small businesses.

“The Supreme Court’s unfair internet sales tax decision – the Wayfair case - has imposed significant, undue burdens on small businesses in New Hampshire and all across the country,” said Senator Hassan. “In effect, the decision forced small businesses to become tax collectors for out-of-state governments…Congress must help small businesses by reversing the Supreme Court’s misguided decision.”

When asked by Senator Hassan about the cost – upwards of $500,000 so far – imposed on Littleton Coin by the patchwork of state tax requirements, Mr. Hennessey shared that “the sheer volume to file taxes in 45 states, on usually a monthly basis, is quite overwhelming. That equates to over 500 tax returns per year.”

Mr. Hennessey continued: “So, what we would like to see for a solution, would be one single registration that covers all states, as well as one annual return per state. That would really help us comply.”

Senator Hassan has been a leader in efforts to try to reverse the Wayfair decision and protect New Hampshire small businesses from having to pay out-of-state taxes and deal with the mountains of red tape in order to comply with the decision. Senator Hassan was part of a group of Senators who reintroduced legislation that would stop states with a sales tax from imposing burdensome out-of-state taxes and tax collection requirements on small businesses as a result of the Supreme Court’s Wayfair ruling. Senator Hassan also joined Senator Jon Tester in reintroducing the Stop Taxing Our Potential (STOP) Act to overturn the Wayfair decision. In 2019, Senator Hassan participated in a field hearing on the internet sales tax collection requirement in Concord to highlight the impact of the Supreme Court‘s out of touch, impractical, and unfair Wayfair decision on small businesses.

###